Weekly Market Pulse - Week ending August 25, 2023

Market developments

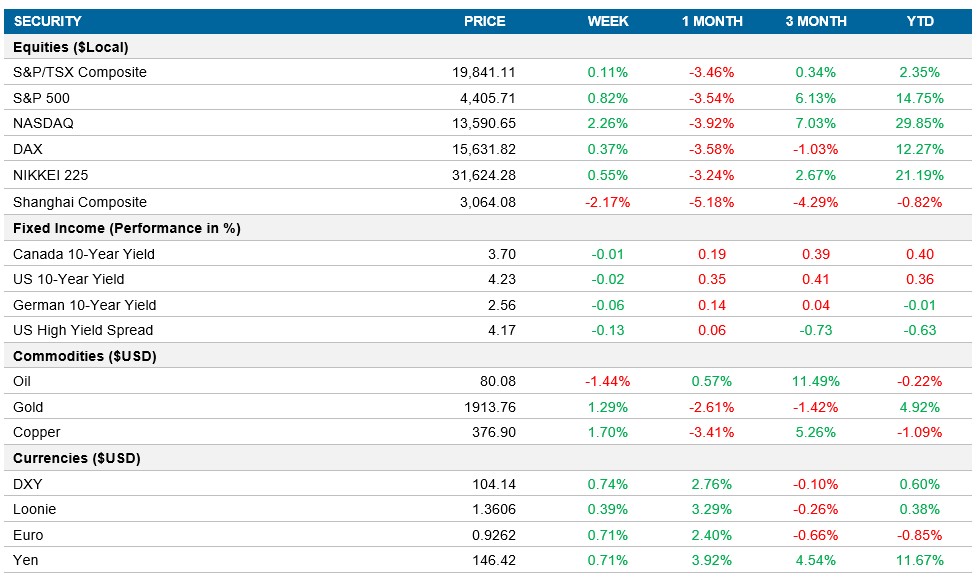

Equities: Stocks climbed as traders analyzed comments from Federal Reserve speakers, including Jerome Powell's statement that officials will be cautious about raising interest rates, signaling a prolonged period of tighter policy. The S&P 500 had its best week since July, led by Nvidia, which closed the week up 6.5% after a volatile earnings week where they hit all-time highs after their release, only to retreat ~8% lower from that point. The Nasdaq was the leader this week, closing 2.3% higher, while the S&P 500 was up 0.82%.

Fixed income: U.S. Treasury movements showed stability in the 10-year while the front-end lagged behind due to Fed Chair Powell's indication of possible rate hikes. 10-year yields remained around 4.23% (relatively flat for the week), with 2-year yields at 5.05%, down 3 basis points on Friday, but up 12bps on the week. Buyers emerged in the front-end, leading to lower yields from peak levels. The market priced rate hike premiums of around 6bp for September's meeting and 17bp for November, higher than the previous close of 15bp.

Commodities: Oil closed the week lower, down 1.5% to $80 per barrel, with back-to-back weekly declines driven by concerns about China's economy. Despite high US crude production and refinery usage, gasoline demand remains weak, down 8% from 2019 levels. Diesel demand is better, but rising fuel prices might affect consumption as crack spreads grow.

Performance (price return)

As of August 25, 2023

Macro developments

Canada – Canadian Retail Sales Show Modest Growth in July

Retail sales in Canada increased by 0.4% in July 2023 compared to the previous month. June saw a slight 0.1% increase in retail sales, outperforming expectations of a stall and matching May's growth. While motor vehicle sales surged (2.5%), gasoline stations and fuel vendors experienced slower growth (0.3%). However, declines were observed in other sectors including food and beverage (-0.9%), general merchandise (-1.5%), health and personal care (-0.5%), and furniture, home electronics, and appliance retail (-1.8%). Yearly sales in June dropped by 0.6%, marking the first decline since the pandemic-induced slump in May 2020.

U.S. – U.S. Composite PMI Falls Below Expectations in August

U.S. Composite PMI dropped to 50.4 in August (below expected 52.0), marking weakest private sector growth since February. Manufacturing contracted, the service sector grew slower, and new orders fell for the first time in six months. Job creation hit three-year low due to inflation and high interest rates. Backlogs shrank sharply, input costs rose (fuel, wages, raw materials), but selling price inflation eased. Firms remain hopeful for future output, citing stabilized rates, higher demand, and reduced-price pressures.

International –U.K. Manufacturing PMI Declines Steeply to 42.5 in August, Eurozone Manufacturing Remains Contractionary in August, Strong Growth in Japan's Private Sector in July

The S&P Global/CIPS U.K. Manufacturing PMI dropped to 42.5 in August, the sharpest contraction since the 2020 pandemic-driven slump. New orders fell due to client hesitation and lower incomes, leading to a sixth consecutive decline in production volumes. Lower costs and improved supply chains led to input price deflation, but demand for input goods decreased inventory levels. Despite this, there's a slight uptick in business activity expectations for goods producers.

The Eurozone Manufacturing PMI improved slightly to 43.7 in August, up from the previous month's three-year low of 42.7, yet still indicating contraction. Factory activity has contracted for 14 consecutive months, with new orders declining rapidly. Output fell for the fifth month, and employment slightly dropped. Despite reduced demand, input deflation slowed, and manufacturers' output expectations declined for a sixth month.

The au Jibun Bank Japan Composite PMI rose to 52.6 in July, marking the eighth consecutive month of private sector expansion. Led by the service sector, this growth was the strongest in three months, despite manufacturing declining for the third month. Output, new orders, and employment grew faster, while overseas orders declined less. Input prices increased due to rising oil prices, and confidence dipped due to concerns about the long-term economy.

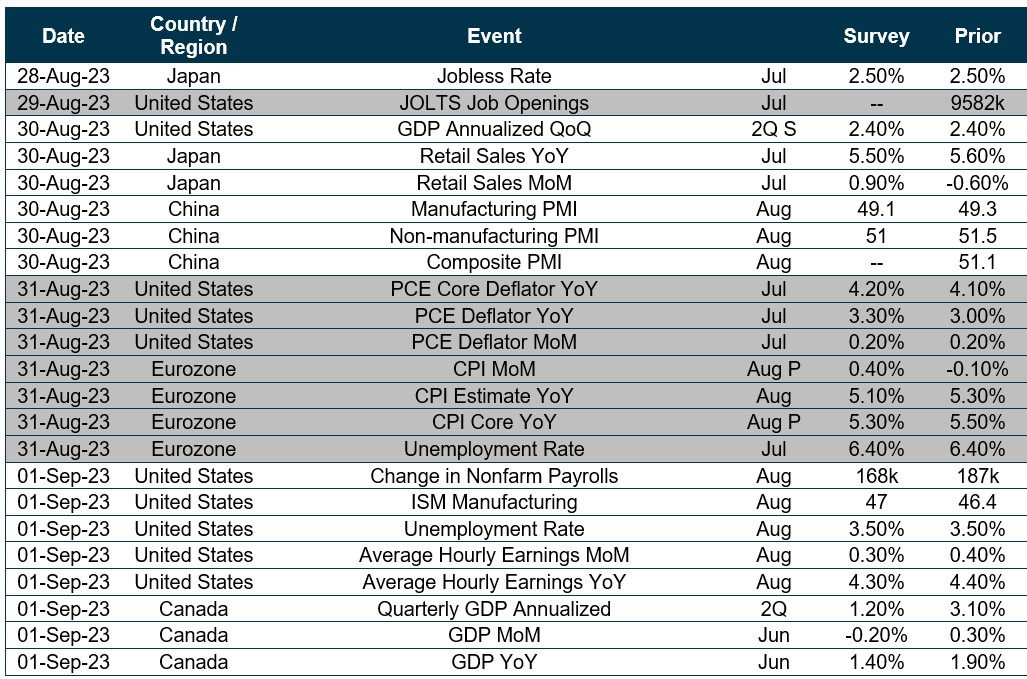

Quick look ahead

As of August 25, 2023