Weekly Market Pulse - Week ending July 12, 2024

Market developments

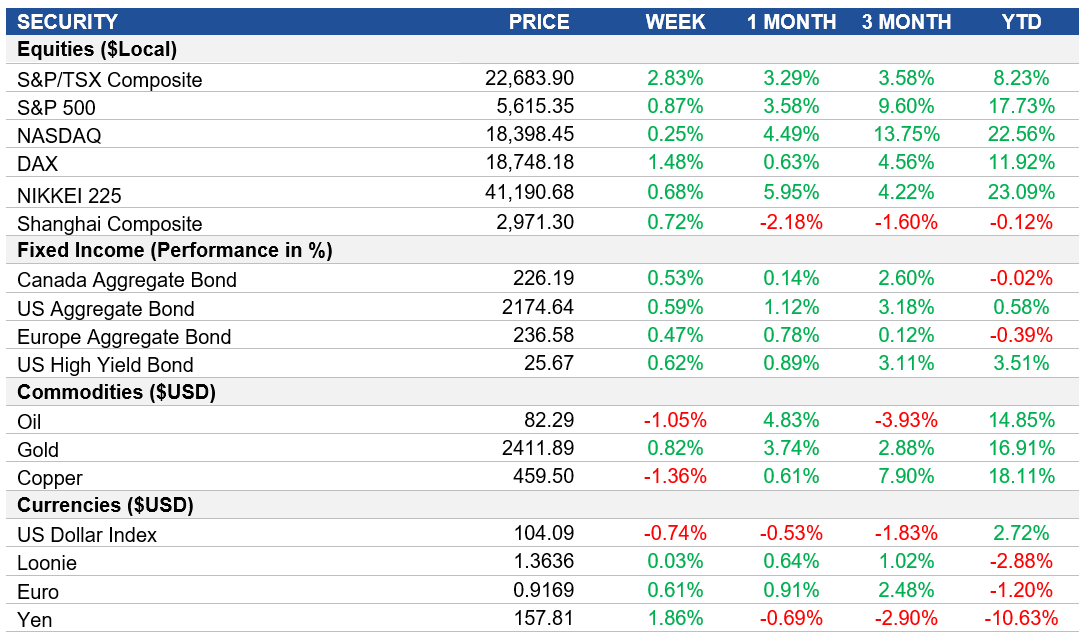

Equities: The S&P 500 Index climbed to around 5,615 to end the week, showing signs of recovery despite the tech-led selloff in the Thursday session. Major banks kicked off the earnings season with mixed results. Wells Fargo saw a 7% decline due to cost-cutting challenges, while JPMorgan reported record profits but missed some key metrics. Overall, the market appears to be in a state of cautious optimism, balancing positive economic indicators with ongoing concerns about inflation and corporate performance.

Fixed Income: U.S. producer prices increased slightly more than expected, but components used to calculate the Federal Reserve's preferred inflation measure were not as concerning. The 10-year Treasury yield decreased below 4.20%, reflecting ongoing market adjustments to this week’s economic data. After a lower than expected CPI print, investors are currently pricing in for September to be the first Fed rate cut.

Commodities: Oil prices remained relatively stable, trading below $83 per barrel. While there are positive signs regarding the cease-fire negotiations in the Middle East, significant challenges remain before a deal can be finalized. This uncertainty continues to influence oil market sentiment.

Performance (price return)

Source: Bloomberg, as of July 12, 2024

Macro developments

Canada – No Notable Releases

No notable releases this week.

U.S. – U.S. Inflation Rate Decline, U.S. PPI Increases Above Expectations

The annual inflation rate in the U.S. fell for the third consecutive month to 3% in June 2024, the lowest since June 2023. Energy costs rose more slowly, and inflation eased for shelter and transportation, with prices continuing to decline for new and used vehicles. Food inflation increased slightly. The Consumer Price Index (CPI) unexpectedly declined by 0.1% from May, the first drop since May 2020, and core inflation slowed to 3.3% annually.

Factory gate prices in the U.S. increased by 0.2% month-over-month in June 2024, following a revised flat reading in May. Service prices rose, especially for machinery and vehicle wholesaling, while goods prices fell, mainly due to a significant drop in gasoline prices. Year-on-year producer inflation rose to 2.6%, the highest since March 2023, with core rates increasing both monthly and annually, surpassing forecasts.

International – China's Consumer Inflation Slowdown, China's Producer Price Deflation, Japan's Producer Inflation Rise

China's annual inflation rate decreased to 0.2% in June 2024, lower than expected, marking the fifth straight month of consumer inflation but the lowest since March. Food prices continued to decline despite a rise in pork prices, and non-food inflation remained stable. The CPI fell by 0.2% monthly, the third drop this year, against expectations of a smaller decline.

China's producer prices fell by 0.8% year-on-year in June 2024, the smallest decline since January 2023, marking the 21st consecutive month of producer deflation. The decrease was driven by lower costs in processing, mining, and raw materials, with consumer goods prices also falling. Monthly producer prices shrank by 0.2%, reversing the previous month's gain.

Producer prices in Japan increased by 2.9% year-on-year in June 2024, the highest since August 2023, with costs rising for transport equipment, food, chemicals, and various machinery. The price of iron and steel remained flat. Monthly, producer prices rose by 0.2%, the smallest increase since February, following a 0.7% rise in May.

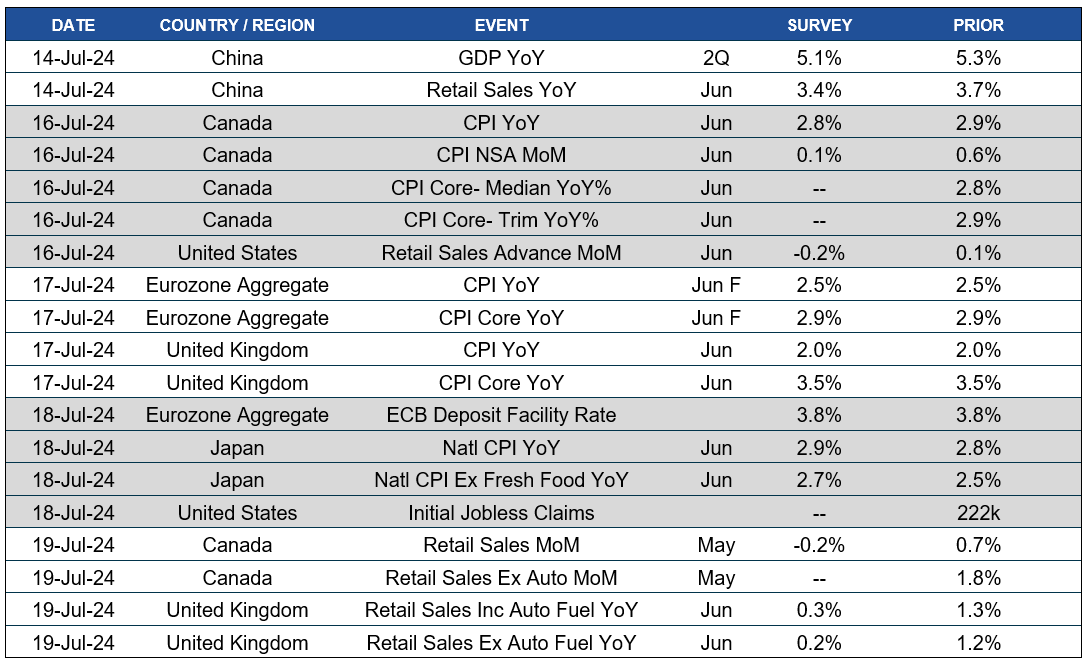

Quick look ahead

As of July 12, 2024