Weekly Market Pulse - Week ending July 8, 2022

Market developments

Equities:

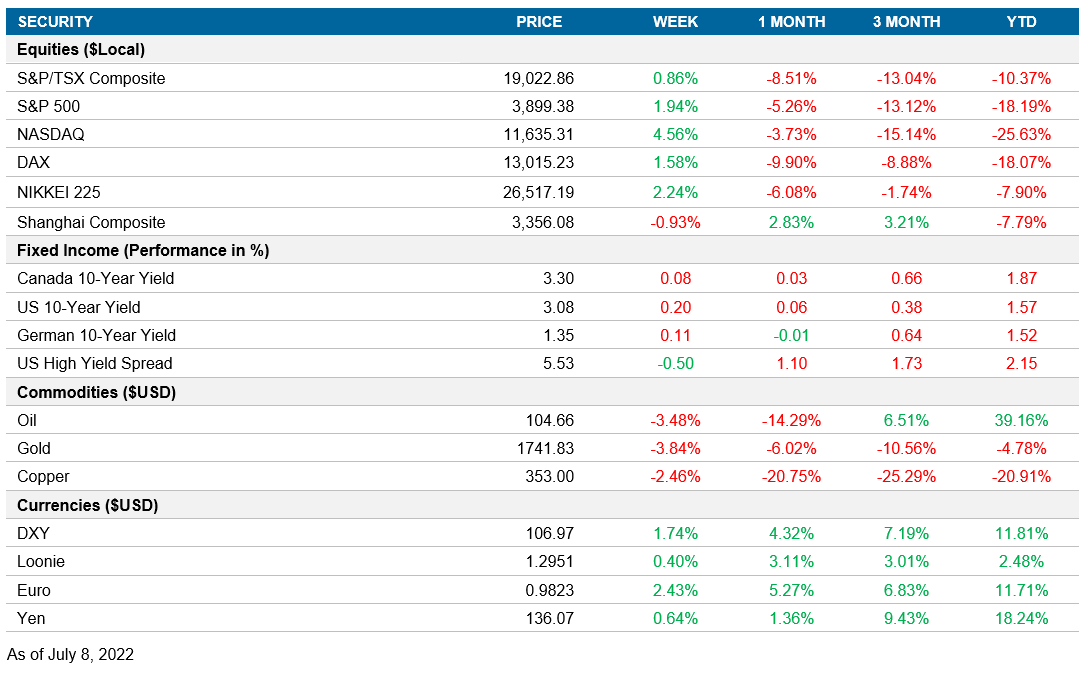

Globally, equities managed to rally despite recessionary concerns and amid mixed narratives on where inflation might be headed. Growth-oriented sectors such as communication services, consumer discretionary, and information technology were the largest contributors to the S&P 500 Index’s positive returns. The tech-heavy NASDAQ benefitted significantly from the strong performance of the information technology sector.

Fixed income:

Bond yields in Canada and the U.S. increased amid strong employment data releases. The low unemployment rate supported the case for 75-basis-point rate hikes from the Bank of Canada and U.S. Federal Reserve later this month.

Commodities:

The oil selloff continues as recession concerns trump supply bottlenecks. The potential for a recession is also being reflected in sustained weakness in copper.

Performance (price return)

As of July 8, 2022

Macro developments

Canada – Unemployment rate reaches record low

StatCan released Canada’s employment data for the month of June. Unemployment has reached a record low of 4.9%, down from 5.1% the previous month. However, it is important to note that the net change in employment was a decrease of 43.2K jobs. This figure mostly comprises workers aged 55-plus that are leaving the workforce. The participation rate took a hit, falling from 65.3% to 64.9%. Wage growth has increased with a surprise to the upside to 5.6%, up from 4.5% the month prior. Accelerated wages, alongside a record low unemployment rate, increase the chances the BoC will execute a 75-bp rate hike the week of July 11.

U.S. – Unemployment rate stabilizes while wage growth remains hot

The Bureau of Labor Statistics reported America’s employment data for June. The unemployment rate remained stable at 3.6% but the participation rate declined to 62.2%. Wage growth for May was revised upwards to 0.4% month over month and 5.3% year over year. In June, wage growth increased 0.3% month over month and 5.1% year over year.

International – Eurozone CPI increases; Eurozone retail sales rise; German industrial production flattens

Eurostat released the eurozone’s preliminary Consumer Price Index findings for June. Inflation has risen past expectations to 8.6% year over year, up from 8.1% the month before. Most of the countries reported increases in year-over-year inflation readings aside from Germany (8.2% y-o-y) and the Netherlands (9.9% y-o-y), which experienced high readings nonetheless. The primary driver of inflation continues to be heightened energy prices, with food prices a secondary driver adding upward pressure to the release. These drivers are highlighted through the decrease in core CPI (excluding food and energy)—core CPI was reported at 3.7% year over year, down from 3.8%.

Eurostat published the eurozone’s retail sales data for May. Retail sales grew by 0.2% month over month and 0.2% year over year. The month-over-month figure was below expectations, but the year-over-year figure beat expectations of

-0.3%. Retail sales growth figures for April were -1.4% month over month and 4.0% year over year. The primary driver of year-over-year growth continues to be gasoline sales, which grew by 5.6%. Despite heightened energy costs, gasoline remains a staple in many European households.

Destatis released Germany’s industrial production data for May. Industrial production surprised on the downside, with month-over-month production coming in at 0.2%. April’s production figure was revised to 1.3% month over month. The primary driver of industrial production was the creation of capital goods, which grew 2.2%. All other industry groups experienced contractions in month-over-month production. Year-over-year production for May showed a contraction of 1.5%, an improvement from a contraction of 2.5% in April.

Quick look ahead

Canada – BoC rate decision (July 13); Manufacturing sales (July 14)

The BoC is announcing its interest rate decision on July 13. Consensus expectations are for the overnight target rate to be increased by 75 bps to 2.25%. Whilst a 50-bp hike is still possible, it is important to note the use of sterner language during the BoC’s last rate decision and steadily worsening inflation data. The recent employment data release is also a red flag for the BoC, since accelerated wages and lower unemployment imply that further tightening is needed. The Fed reporting a 75-bp hike during its last announcement made it more likely that many countries, including Canada, would follow suit.

StatCan is releasing the manufacturing sales data for May. During April, manufacturing sales experienced month-over-month growth of 1.7%.

U.S. – CPI (July 13); PPI (July 14); Empire Manufacturing survey (July 15); Retail sales (July 15); Industrial production (July 15); U. of Mich. sentiment survey (July 15)

The Bureau of Labor Statistics (BLS) will release June’s CPI data. Economists are expecting inflation to continue increasing. Forecasts are for readings of 8.8% year over year and 1.1% month over month. Rising food and energy prices are expected to continue acting as upward pressure on inflation.

BLS will publicize June’s Producer Price Index data. Consensus expectations are for PPI and core PPI to hold at their previous values of 0.8% and 0.5% month over month, respectively.

The Federal Reserve Bank of New York will release the Empire Manufacturing survey results for July. Economists are expecting the index to continue decreasing, with a reading of -3.8. June’s reading was an index value of -1.2.

The Census Bureau will release June’s retail sales data. During May, retail sales experienced a contraction due to the weakened automobile sector. Consensus expectations are for retail sales to grow by 0.9% month over month.

The Fed will release the industrial production data for June. Production growth has been slowly flattening, and economists believe there will be no growth or contraction with a forecast of 0.0%.

The University of Michigan will issue its preliminary release of its sentiment survey for July. Consensus estimates are for sentiment to remain low, with a prediction of a 49.0 reading.

International – China’s PPI (July 8); China’s CPI (July 8); Japan’s PPI (July 11); U.K. industrial and manufacturing production (July 13); China’s industrial production (July 14); China’s retail sales (July 14)

China’s National Bureau of Statistics will release the country’s PPI data for the month of June. China’s PPI has had a downward bias throughout 2022, with the last release reporting 6.4%. Consensus estimates are expecting a reading of 6.0% year over year.

Chinese CPI data for the month of June will be released alongside the PPI release. Economists are expecting inflation figures of 2.4% year over year. Last month, Chinese inflation came in at 2.1% year over year. Chinese inflation remained low due to access to cheaper supplies of carbon-based fuels and due to reduced demand for goods and services during the lockdown. Economists are expecting inflation to increase alongside increasing demand for goods and services since lockdown measures were lifted on June 1.

The Bank of Japan will be releasing June’s PPI data. Japan’s PPI has been high throughout the first quarter, but has started easing during May. Consensus estimates are for input prices to report a reading of 8.9%, down from the prior 9.1% reading.

The U.K. Office for National Statistics will release the country’s production data for May. Industrial production experienced a 0.6% contraction during April and manufacturing production saw a 1% contraction during the same month.

China’s NBS will release the country’s industrial production data for June. Sharing the reopening theme, consensus expectations are for production to increase 4.3% year over year, up from growth of 0.7% the month prior.

The NBS will also publish China’s June retail sales data. During May, retail sales experienced a contraction of 6.7% year over year due to ongoing pandemic restrictions. Economists are expecting retail sales to improve, with growth of 0.4% year over year.