Weekly Market Pulse - Week ending March 10, 2023

Market developments

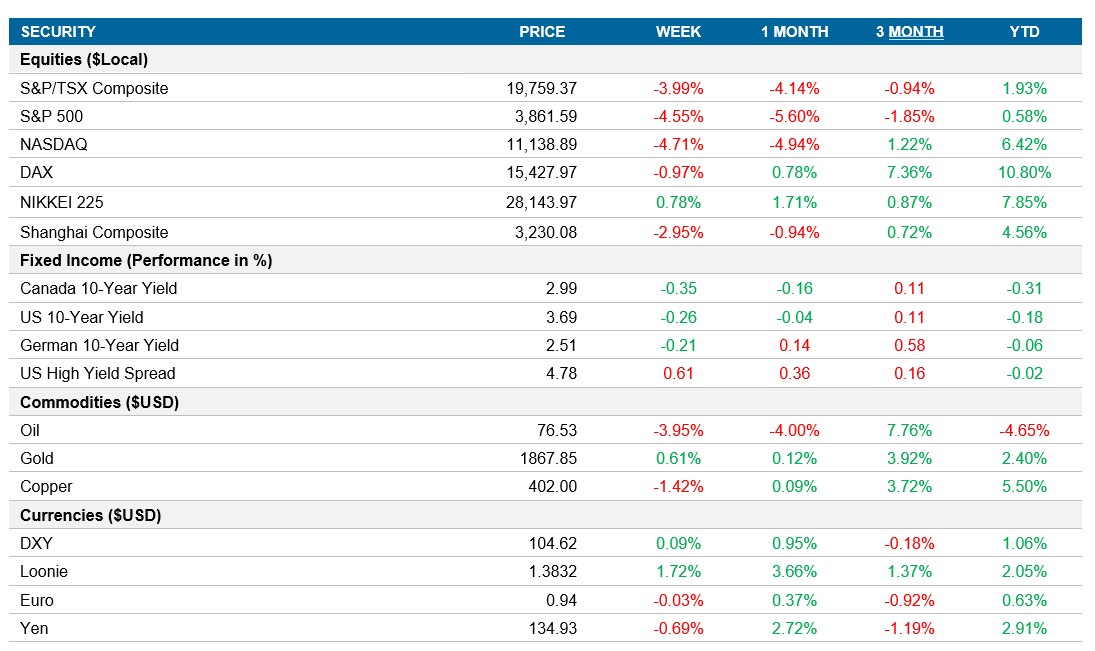

Equities: The S&P500 finished the week down over -4.5%, the Nasdaq down -4.7% and the TSX around -4% as the turmoil caused by SVB Financial Group created concern within the banking sector and led to a spike in market volatility as the VIX hit 29 on Friday. Investors will shift their focus to the inflation data next week as they weigh the probability of a 50bps rate hike in March vs previous estimates of 25bps.

Fixed income: The bond market rallied on Friday as traders are now expecting a 25bps rate hike in March and lowered the overall expectations for peak rates by nearly 40bps. This move was driven by the jobs numbers on Friday that showed a tick up in the unemployment rate in the U.S. and slower than expected wage growth. The US 10yr closed more than 25bps lower at 3.68% and the Canadian 10yr was also down, closing at 2.99%

Commodities: Oil closed higher on Friday after better-than-expected U.S. jobs data, but still finished the week down -4%. Expectations of rising interest rates in the U.S. and Europe clouded the outlook for growth and pressured oil earlier in the week. Like other assets, next week’s inflation will be crucial as the need for higher rates will increase the likelihood of a recession and potentially impact the demand for oil.

Performance (price return)

As of March 10, 2023

Macro developments

Canada – Canadian unemployment rate held at 5.0%

The Canadian unemployment rate held at 5% in February, slightly below market forecasts of 5.1%. The result signaled continued tightness in the labour market and challenged the Bank of Canada’s expectations that weak economic growth would pressure the labour market.

U.S. – The U.S. creates more jobs than expected, average hourly earnings came in lower than expected and the unemployment rate was 3.6% compared to expectations of 3.4%

The U.S. economy created 311K jobs last month, ahead of market forecasts of 250K. The reading continues to point to a tight labour market as it is well above the ~100K target. We saw notable increases in hospitality, retail trade and government jobs.

On the more positive side, average hourly earnings increased by 4.6% YoY and although it’s up from 4.4% the prior month, it was below market expectations of 4.7%. The U.S. unemployment rate also moved up to 3.6%, above market expectations and up from the 3.4% low we saw in January.

International – Eurozone retail sales miss expectations, U.K. GDP expands by 0.3% and China inflation slows to 1%

Eurozone retail sales increased by 0.3% compared to January, below expectations of 1%. Sales were up for food and drinks, as well as non-food goods. On the other hand, fuel sales declined sharply by -1.5%. On a yearly basis, they declined 2.3%. the fourth consecutive month of contraction. The British economy expanded by 0.3% MoM in January, bouncing back from a -0.5% contraction a month earlier. The services grew by 0.5%, led by education and we saw a drop in pharmaceutical products and construction. GDP was flat from November through January.

China’s inflation rate dropped to 1% in February, from 2.1% a month earlier and well below market forecasts of 1.9%. This was the weakest print since February of last year as both food and non-food prices eased. The slowdown in pork prices led to lowest food inflation in nine months. On the other hand, health and clothing prices rose faster.

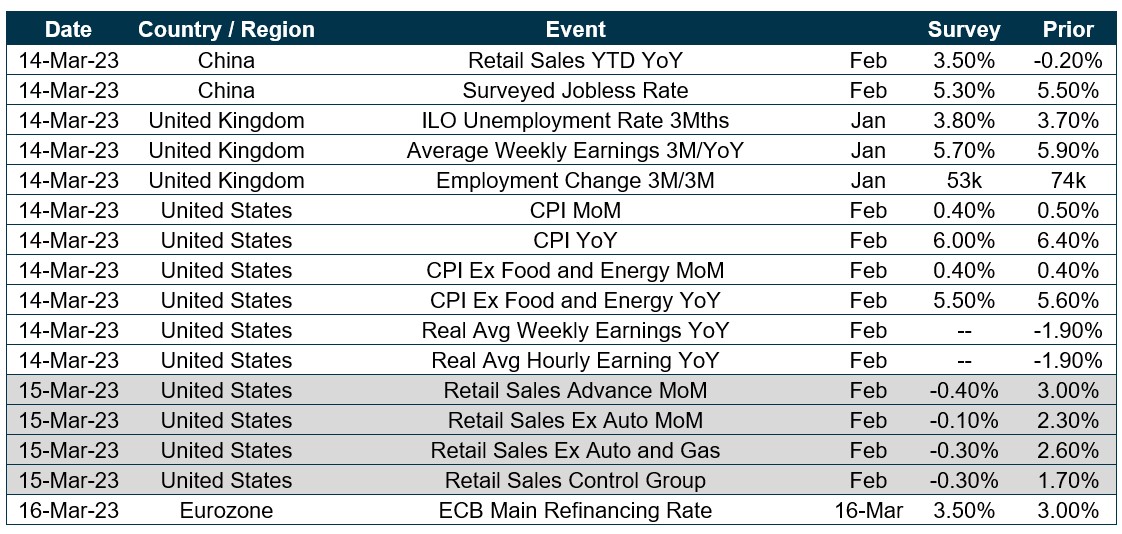

Quick look ahead

As of March 10, 2023