Weekly Market Pulse - Week ending March 31, 2023

Market developments

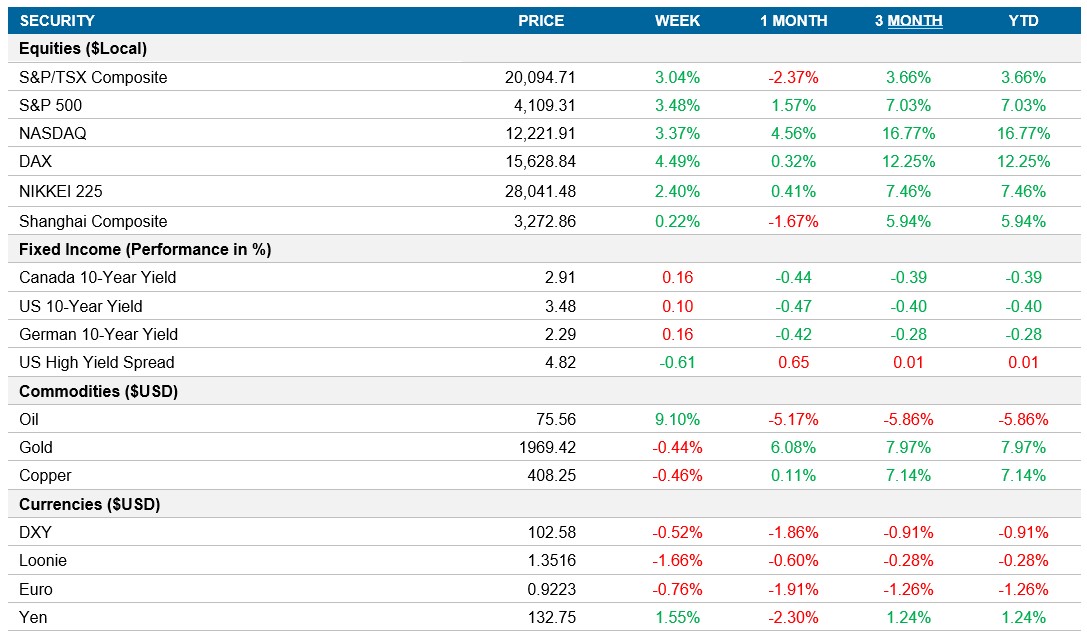

Equities: U.S. equities rallied on Friday and extended the weekly gains to over 3% for both the S&P 500 and Nasdaq as key inflation measures showed signs of cooling, signalling that the Fed may be close to ending it’s tightening cycle. Ending the month of March in the green for the U.S. is meaningful given the banking crisis we faced only a few weeks ago. The Nasdaq closed out it’s best quarter since 2020, up over 16%, while the S&P 500 and TSX were up over 7% and 3.5% respectively.

Fixed income: Treasury yields in the U.S. fell on Friday, ending a quarter of volatility and erratic swings. Traders are still trying to weigh the impact of the banking collapse and the economic data to determine where the Fed should pause their rate hikes. The U.S 10yr yield bounced off the 3.4% level and closed just below 3.5%, the 2yr yield closed back above 4%, and the Canadian 10yr closed up 16bps to 2.9%.

Commodities: Oil settled at its highest level in nearly three weeks as it closed about $75 and up 9% for the week as concerns over the U.S. and Euro banking crisis eased. However, it finished the month lower for the fifth consecutive time as concerns over a potential recession and a decline in demand pressured the commodity.

Performance (price return)

As of March 31, 2023

Macro developments

Canada – GDP rose 3% YoY in January

Canada’s GDP rose in January by 0.5% MoM (3% YoY), above market estimates of 0.4%. The gain was broad based but led by a 1.1% MoM increase in mining and oil as well as a 0.7% MoM increase in manufacturing GDP. Preliminary estimates pointing to a strong 0.3% gain MoM in February was also positive.

U.S. – PCE Price index decelerates in February

The U.S. PCE Price Index increased by 0.3% MoM in February, decelerating from a 0.6% rise a month earlier and in line with market estimates. Core PCE also came in at 0.3% MoM signalling that inflation may have peaked and that the Fed’s tightening cycle may soon be coming to an end.

International – Eurozone inflation cooled to 6.9% while the unemployment rate held at 6.6%, China’s PMI jumped to 57.0

Eurozone core inflation estimates were up 5.7% in March and headline inflation plunged to 6.9% down from 8.5% in February. Underlying inflation remains elevated and ECB officials say interest rate hikes aren’t over.

Eurozone unemployment rate stayed at a record low of 6.6% in February, unchanged from January and below estimates of 6.7%. Within the Eurozone economies, the highest jobless rates were seen in Spain, Italy, and France, where the lowest was in Germany.

China’s composite PMI went up from 56.4 to 57.0 in March, marking the highest level since 2011 and signalling that the recovery is still going strong. The increase was driven by non-manufacturing PMI, which rose to 58.2 from 56.3 as in-person activity boosted the services index.

Quick look ahead

As of March 31, 2023