Weekly Market Pulse - Week ending May 10, 2024

Market developments

Equities: The S&P 500 closed near 5,225, for its third straight weekly gain, while the Dow rose for an eighth consecutive session. The stock market lost momentum after economic data pointed to a slowing economy amid persistent inflationary pressures, challenging the outlook for Federal Reserve rate cuts. Traders will closely watch Powell's remarks next week and the upcoming CPI data for clues on the Fed's policy path amid choppy growth and inflation signals.

Fixed Income: U.S. treasury 10-year yields remained flat at 4.50%, Fed officials like Dallas President Lorie Logan said it's too early to consider rate cuts given disappointing inflation data, while Chair Jerome Powell signaled rates would likely stay high for some time. Economic growth slowed sharply in Q1 2024, but markets still expect the Fed to start cutting rates by year-end, with two 25 basis point cuts seen as more likely than one.

Commodities: Geopolitical risks continue to support oil prices, though the Israel-Hamas conflict has not yet impacted production or exports from Persian Gulf countries. Despite expectations for OPEC+ to maintain cuts, RBC's Helima Croft noted the possibility of "another plot twist" if there is a major change in market dynamics or a breakthrough in U.S.-Saudi negotiations.

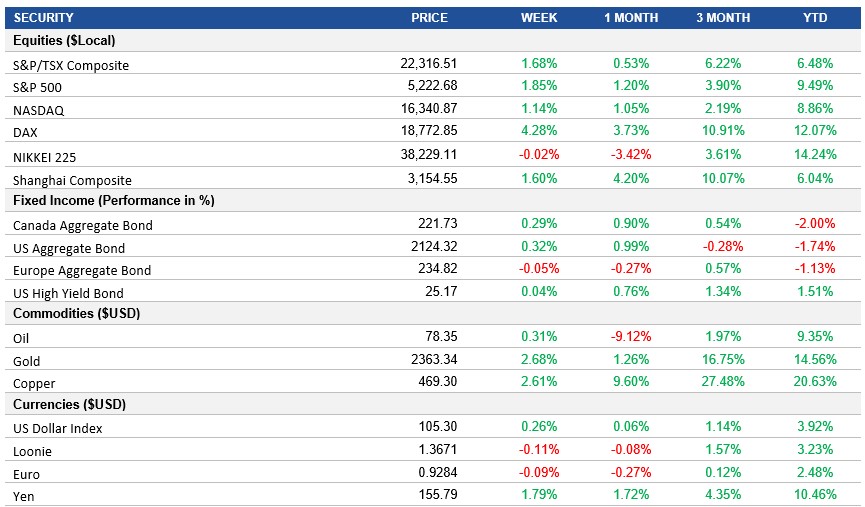

Performance (price return)

Source: Bloomberg, as of May 10, 2024

Macro developments

Canada – Canadian Unemployment Holds Steady

Despite Canada's unemployment rate remaining steady at 6.1% in April 2024, youth and older populations experienced increased joblessness, while core working-age individuals saw a slight decrease. However, net employment surged by 90,400, tempering the urgency for a rate cut by the Bank of Canada.

U.S. – No Notable Releases

No notable releases this week.

International – Bank of England Holds Rates, British Economy Expands, Eurozone Industrial Production Decreases, Eurozone Sales Rebound, China’s Composite PMI Continues to Expand

The Bank of England maintained its key bank rate at 5.25%, with two committee members advocating for a reduction. Economic projections foresee a decline in the bank rate to 3.75% by the forecast period's end, aiming to sustainably return inflation to the 2% target.

The British economy expanded by 0.6% in the first quarter of 2024, surpassing forecasts and exiting the previous year's recession. Services and production sectors experienced growth, while household consumption and government spending increased, though net tourism had a negative impact.

Industrial producer prices in the Eurozone decreased by 7.8% year-on-year in March 2024, primarily driven by declines in energy prices. Inflation slowed across various goods categories, while monthly producer prices declined by 0.4%.

Retail sales in the Eurozone rebounded by 0.8% in March 2024, indicating renewed consumer activity, especially in automotive fuel and food sectors. This increase marks the first growth in retail since September 2022, aligning with other positive economic indicators.

The Caixin China General Composite PMI for April 2024 was 52.8, showing continued growth in private sector activity for the sixth consecutive month. While new orders increased, employment levels decli

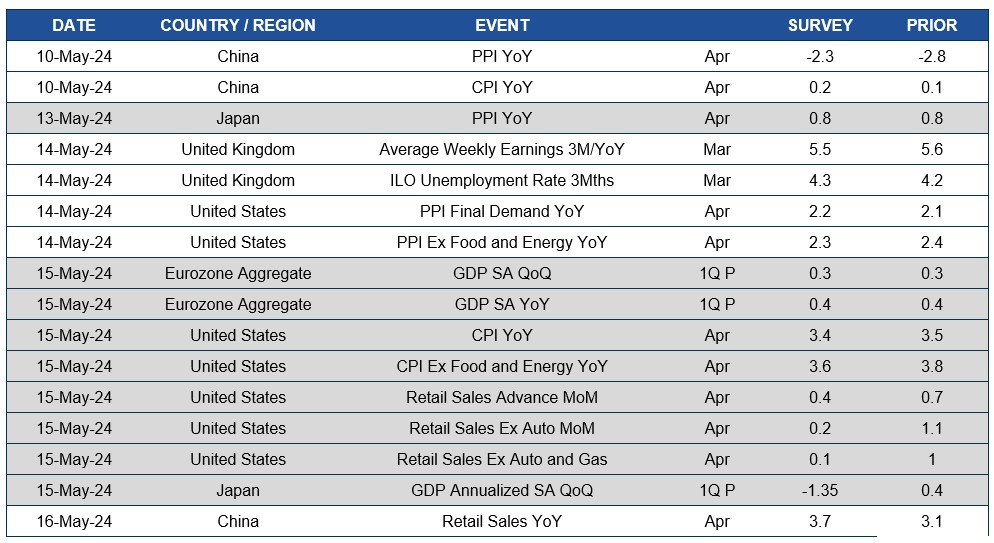

Quick look ahead

As of May 10, 2024