Weekly Market Pulse - Week ending November 10, 2023

Market developments

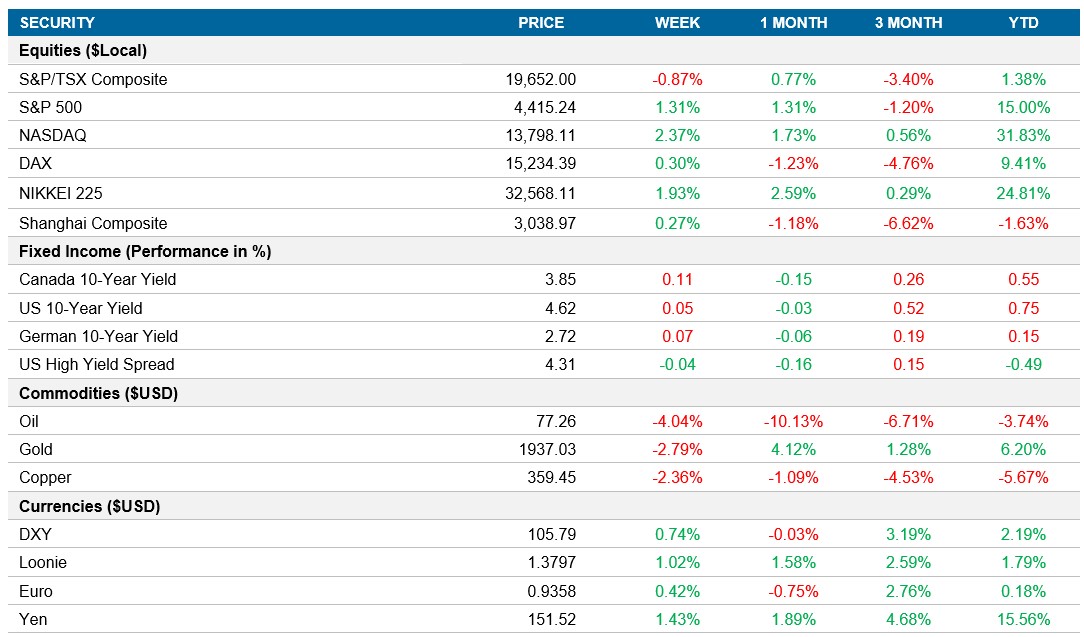

Equities: Stocks rebounded as Treasury volatility eased, with the S&P 500 crossing the crucial 4,400 technical mark and finished the week up 1.3% to a seven-week high. Tech giants, including Microsoft and Nvidia, led gains, propelling the Nasdaq over 2% higher for the week. Investors appear less reactive to data, with year-end optimism driven by expectations of declining U.S. bond yields, according to Bank of America. Cash remains a preferred asset, but inflows into equity indexes are anticipated, supported by earnings growth among quality companies.

Fixed income: Despite a weak government bond sale and Jerome Powell's remarks on potential tightening, two-year yields closed above 5%, while 30-year bond yields fell. The U.S. 10yr was relatively flat this week, only increasing 4bps; however, traders will be closely watching the economic data next week as key inflation data will be released on Tuesday and Wednesday.

Commodities: Oil futures ended higher on Friday but experienced a third consecutive weekly decline due to concerns about demand outlook and expectations of a supply surplus, overshadowing Middle East supply risks. Weak economic data from China and fears of a potential U.S. and global slowdown have become major concerns for traders. Despite geopolitical tensions, sentiment in the oil market shifted, leading to a marked correction.

Performance (price return)

As of November 10, 2023

Macro developments

Canada – No Notable Releases

No notable releases this week.

U.S. – No Notable Releases

No notable releases this week.

International – U.K. Economy Grows a Touch Higher Than Expected, Eurozone PMI in Line with Expectations, Eurozone PPI Falls by Over 12%, Japan Composite PMI Revised Higher, China PPI Declines for the 13th Straight Month

The U.K.'s economy stagnated in Q3, showing a 0.1% fall in services offset by a 0.1% increase in construction. Business investment, household spending, and government consumption declined. GDP grew 0.6% compared to the same quarter last year. Bank of England projects a meager 0.1% rise in Q4 amid high inflation and interest rates.

The HCOB Eurozone Composite PMI for October dropped to 46.5, driven by a downturn in service providers and fragile demand conditions. New business intakes declined significantly, ending a 32-month period of job creation. Goods and services saw the slowest price increases since February 2021, with input cost inflation cooling.

Industrial producer prices in the Eurozone fell by a record 12.4% YoY in September, driven by energy and intermediate goods. Retail sales declined by 0.3% in September, marking the third consecutive month of decrease. Non-food products and online trade recorded significant drops, reflecting challenges in consumer demand due to high inflation and borrowing costs.

The au Jibun Bank Japan Composite PMI for October was revised to 50.5, indicating the tenth straight month of private sector expansion, albeit at the weakest pace. Manufacturing output declined, but services activity rose. Input costs moderated, and output charges increased solidly. Despite easing for the sixth consecutive month, sentiment remained upbeat.

China's producer prices declined by 2.6% YoY in October, marking the 13th consecutive month of deflation. Costs for means of production declined, especially in materials and mining, while consumer goods prices fell, influenced by food and durable goods. On a monthly basis, producer prices remained flat in October after two months of increase.

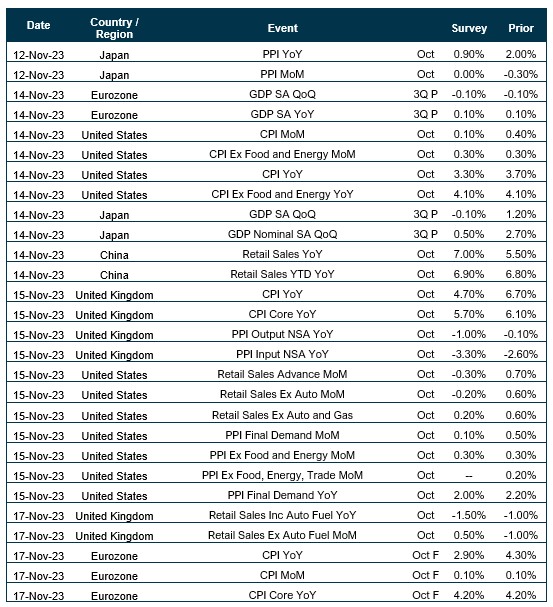

Quick look ahead

As of November 10, 2023