Weekly Market Pulse - Week ending October 27, 2023

Market developments

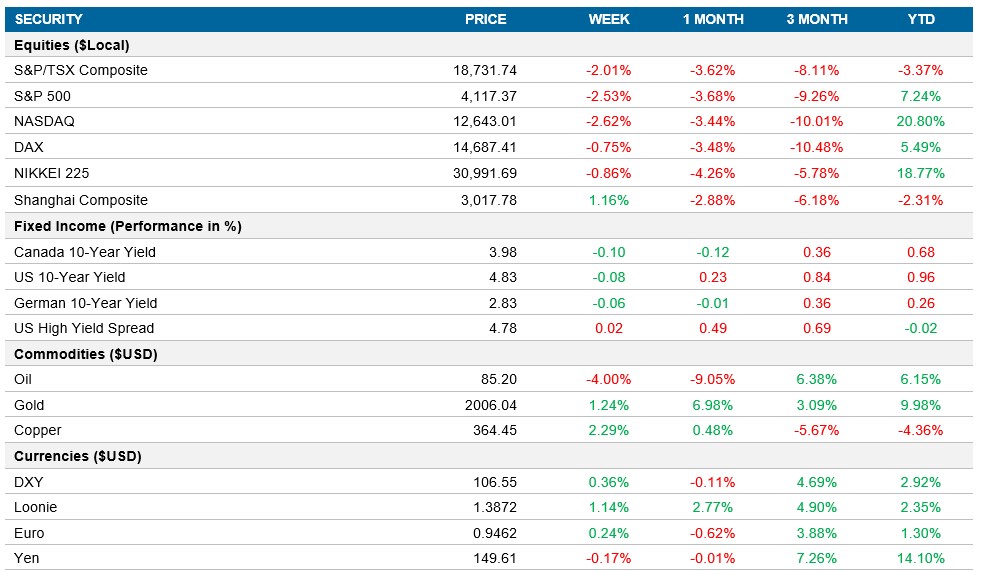

Equities: The equity markets experienced increased volatility with erasing earlier gains, heading for their worst week in a month. This was driven by hotter inflation numbers, the S&P 500 extended a 10% slide from its peak in July, entering "correction" territory. Mega-cap earnings were mixed in the U.S. as Microsoft and Amazon posted strong numbers that drove them higher, while Alphabet and Meta struggled. The S&P 500 closed down 2.5%, while the TSX was 2% lower on the week.

Fixed income: Near-term inflation views rose to a five-month high of 4.2%, as reported in a University of Michigan sentiment survey. While there is an expectation of decreasing inflation, it remains at a high level from the Fed's perspective. U.S. Treasury 2yr yields edged lower as traders reacted to the inflation data and ended the week down 7bps, while the 10yr was done 8bps to 4.83%.

Commodities: Oil prices were down to $85 to end the week but increased on Friday due to escalating tensions in the Middle East, raising concerns about potential oil supply disruptions. However, the market seemed somewhat desensitized to geopolitical posturing, focusing on the prospect of widespread war as a major trigger for concerns.

Performance (price return)

As of October 27, 2023

Macro developments

Canada – Bank of Canada Holds Rates Steady

In October, the Bank of Canada kept its overnight rate at 5%, as expected. This decision reflects concerns about economic activity and inflation, with an expectation that inflation will eventually retreat to 2% by 2025.

Retail sales in Canada remained steady, but the preceding month saw a 0.1% decline, primarily due to disruptions caused by port strikes in British Columbia, with approximately 12% of surveyors reporting lower business activity because of issues with supply chain logistics from the strikes.

U.S. – U.S. Manufacturing PMI Up, Strong U.S. Q3 GDP Growth, U.S. PCE Inflation Steady

The U.S. Manufacturing PMI rose to 50 in October 2023, indicating improved conditions for manufacturing firms. However, reduced input buying and challenges like labour and material shortages affected the supply chain.

The U.S. economy expanded by 4.9% in Q3 2023, surpassing expectations. Consumer spending, exports, and government spending contributed to the growth, while non-residential investment contracted.

The U.S. PCE inflation rate remained at 3.4% in September 2023, with core PCE inflation at 3.7%. Both figures were in line with forecasts.

International – U.K. Composite PMI Shows Contraction, Eurozone Composite PMI Declines, ECB Maintains High Interest Rates, Japan Manufacturing PMI Deteriorates

The U.K. Composite PMI in October indicated a reduction in private sector output for the third consecutive month. Service and manufacturing sectors contracted, and there were challenges in pricing and business confidence.

The Eurozone Composite PMI dropped to 46.5 in October, signaling a significant decline in business activity. This was influenced by falling orders, depleted backlogs, and reduced employment levels.

The European Central Bank, after a series of rate hikes, decided to maintain high interest rates in its October meeting. This reflects a more cautious stance due to easing price pressures and concerns about a recession.

The au Jibun Bank Japan Manufacturing PMI remained at 48.5 in October 2023, indicating continued deterioration in operating conditions. Challenges include reduced new orders and employment levels, with weakening business sentiment.

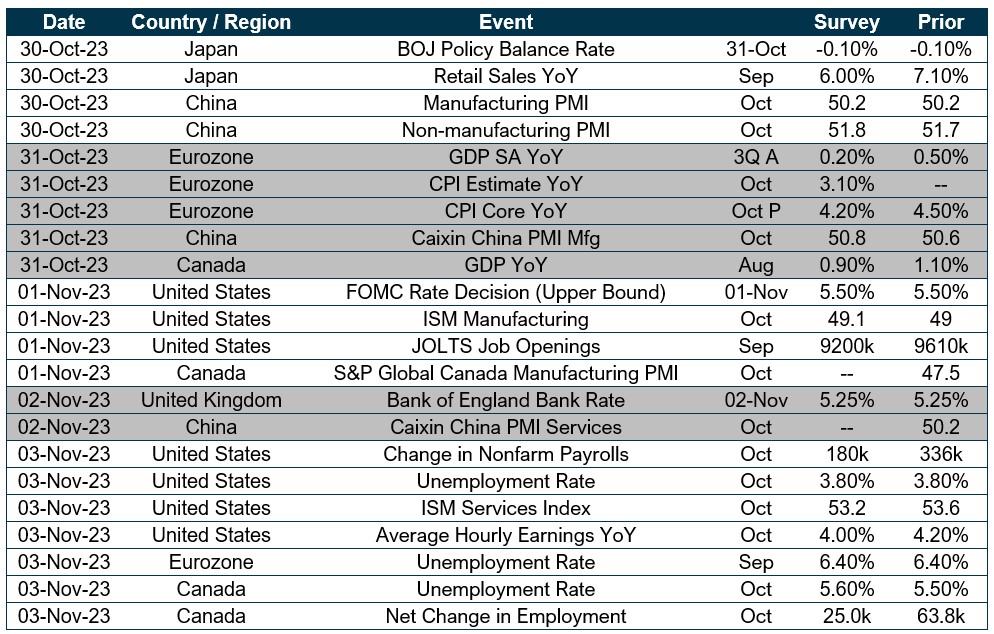

Quick look ahead

As of October 27, 2023