Weekly Market Pulse - Week ending September 16, 2022

Market developments

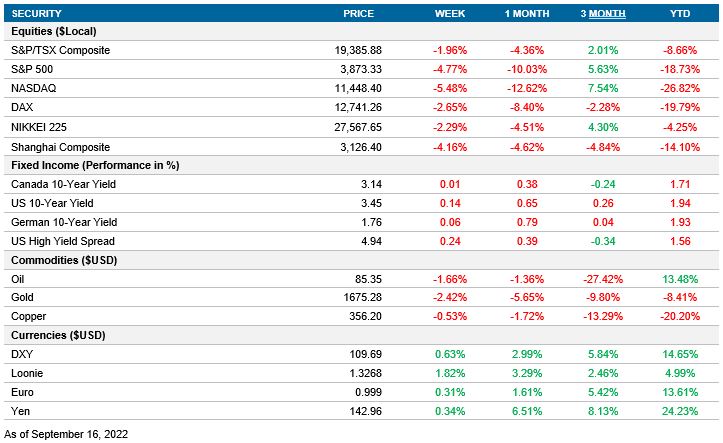

Equities: The equity market suffered its worst week since hitting a previous low in June. The main driver for this negative week was the latest U.S. CPI reading that came in higher than expected and surprised the market.

Fixed income: The long end of the curve reacted mildly to the new inflation data, continuing their upward movement. However, 2-year treasury rates increased from 3.56% to 3.86%, with continued expectations of a more hawkish path from the Fed.

Commodities: Crude Oil continued with its decline, with a third negative week because of the slowdown of global growth. If the deterioration continues, the oil market will have the first negative quarter in more than two years.

Performance (price return)

As of Sept 16, 2022

Macro developments

Canada – No notable releases

No notable releases for the week.

U.S. – CPI increases, Retail Sales Increases

This week’s main event was the inflation data that surprised by coming in higher than expected. The new reading of 0.1% month over month was above the previous value of 0.0% and greater than the market consensus of -0.1%. Even though the price of Gasoline decreased during August, it was not enough to compensate for the increase in rent prices. Along with an increase in headline inflation, core inflation (the reference measure for the Fed) also surprised to the upside with a reading of 0.6% versus a market expectation of 0.3%.

The inflation data not only increased the implied hike for the next meeting from 73bps to 80bps but also increased March’s implied hike peak rate from 4.0% to 4.4%

The U.S. Census Bureau published August’s Adjusted Retail & Food Services Sales, which showed an increase of 0.3% versus an expected decline of 0.1%. The same report revised July’s reading from 0.0% to -0.4%. If both metrics are analyzed together, it indicates the demand for goods cooled in the previous month.

International – UK’s Unemployment Rate decreases; UK’s CPI decreases; China’s Industrial Production Increases

The National Bureau of Statistics of China released August’s Industrial Production. The value added from the industry increased by 4.2% from a previous growth of 3.8% and a consensus expected value of 3.8.% Despite the COVID outbreaks in all 31 mainland provinces, this improvement could signal that the Chinese economy might recover.

The Office for National Statistics published August’s U.K. Unemployment rate, which is at a 47-year record low , the latest value of 3.6% was 0.2% lower than July’s reading and 0.2% lower than the market consensus. A decrease in labour demand mostly drove this mild value.

In addition, the new CPI data surprised by coming in lower than expectations. Even though the market consensus expected a deceleration in the YoY inflation rate of 10.0%, the latest reading was even lower, with a growth of 9.9%. The decrease in oil prices was the main driver for this ease in inflation, and it’s expected that they will fall even more in the coming months.

Quick look ahead

Canada – CPI (September 20)

Statistics Canada will publish August's CPI on September 20. July’s inflation data of 7.6% was in line with market consensus and decelerated from the previous month’s 8.1% value. August’s data will be vital to understanding the inflation path, given that even though headline inflation is cooling down, July's average core measure jumped to 5.3%, the highest value since 1990.

U.S. – Central Bank Meeting (September 21); Manufacturing PMI (September 23)

The Federal Open Market Committee will meet next Wednesday to decide the fed funds reference level. After a higher-than-expected CPI reading, the market expects a rate hike of 75 bps. In addition, the FOMC will publish a new Summary of Economic Projections that will indicate the Fed’s view on the interest rate path.

S&P Global will release the new U.S. Manufacturing PMI for September. After falling for two months in a row with a reading of 51.5, the market consensus is that the index will continue declining with a forecast of 51.3.

International – U.K.’s and Japan’s Central Bank Meeting (September 22); Euro Area’s, Germany’s and Japan’s Manufacturing PMI (September 23)

Next week will be loaded with Central Bank meetings (Sweden, U.S., Brazil, U.K., Japan, Indonesia, Norway, Philippines, South Africa, Taiwan, and Turkey). As a highlight, the Bank of England will decide its new policy rate after pushing last week’s meeting due to the death of Queen Elizabeth II. In Asia, the Bank of Japan will meet this week, but the market expects it to keep its policy rate unchanged. However, the BoJ might expand its lending programs to promote investments.

In addition to the Central Bank Meetings, multiple Manufacturing PMI will be published (U.S., Euro Area, Germany, and the U.K.). The evolution of these indexes will guide the market on how fast the global economy is decelerating as a consequence of the tightening cycle of the multiple central banks.