Weekly Market Pulse - Week ending August 12, 2022

Market developments

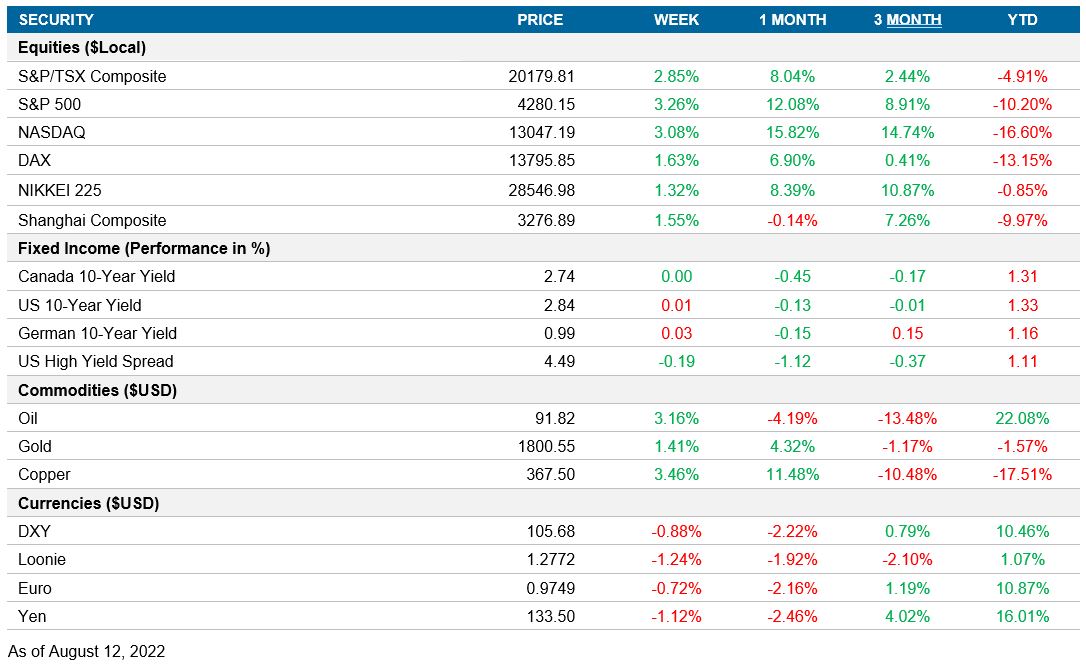

Equities: Equities saw a strong rally after U.S. July inflation data was released mid-week, which was below estimated and showed inflation slowing. Investor sentiment was bolstered by the possibility that the Federal Reserve may be more dovish than previously anticipated.

Fixed income: Yields remained relatively unchanged but were volatile over the week. U.S. high yield spreads continued their trend of strong tightening.

Commodities: Oil rallied after the International Energy Agency raised its demand forecast. Copper rallied alongside the peaking inflation narrative and a more favourable assessment of the outlook for global growth.

Performance (price return)

As of August 12, 2022

Canada – No notable releases

No notable releases for the week.

U.S. – CPI releases flat; PPI falls; University of Michigan consumer sentiment improves

U.S. CPI was lower than expected and remained flat for the month of July. CPI readings were 8.5% year-over-year and 0.0% month-over-month. The price of gasoline has fallen by 7.7% but the decrease was offset by a 1.1% increase in the cost of food and a monthly increase of 0.5% in shelter costs. This CPI release was good news for the Fed and equity markets, because it signaled that inflation may have peaked in the short term.

The U.S. Producer Price Index followed a similar trajectory to CPI, falling below consensus estimates. PPI had a reading of 9.8% year-over-year and -0.5% month-over-month. The price of final demand goods fell by 1.8%, whereas the price of final demand services increased by 0.1% month-over-month. The decrease in the price of goods is attributed to a 9.0% month-over-month decrease in energy prices. This was offset by a 1.0% month-over-month increase in food prices.

The University of Michigan’s preliminary release of their August consumer sentiment survey released with a surprise on the upside. Consumer sentiment had a reading of 55.1–up from 51.5, and consumer expectations had a reading of 54.9–up from 47.3. Both sentiment and expectations had tailwinds from declining energy costs, leading consumers to lower their 2023 inflation expectations (median) to 5.0%. However, inflation is still the elephant in the room and 48% of consumers blame inflation for reducing their quality of life.

International – China’s CPI rises but PPI falls; U.K. GDP falls; U.K. industrial and manufacturing production falls; Eurozone industrial production rises

China’s CPI data release for July came in below expectations. Consensus estimates were 2.9% year-over-year and 0.5% month-over-month. The actual CPI figures were 2.7% year-over-year and 0.5% month-over-month. The primary driver of Chinese inflation was food prices, which rose 6.3% year-over-year. The price of pork demonstrated a sharp increase of 20.2% year-over-year. Food prices surged due to ongoing demand momentum from June amid tighter supplies.

China’s July PPI release shared a similar narrative with their CPI. PPI came in weaker than expected with a value of 4.2%, down from 6.1% year-over-year in June’s release. Energy and metal prices have fallen during the month of July as a recessionary narrative was popularized in the U.S. This alleviated cost pressures many Chinese producers were facing.

The U.K.’s second quarter GDP estimates released with a surprise on the upside. GDP was estimated to have contracted by 0.1% quarter-over-quarter. The year-over-year figure showed an expansion of 2.9%. Government consumption fell for a second consecutive quarter by 2.9%. Household consumption has also fallen by 0.2% quarter-over-quarter, mainly due to high inflation tightening household budgets.

U.K. industrial and manufacturing production released above expectations for the month of June. Industrial production had a contraction of 0.9% and manufacturing production had a contraction of 1.6% month-over-month. The fall in industrial production is attributed to the manufacturing decrease and a 1.8% month-over-month decrease in mining/quarrying. The fall in manufacturing production was broad based and only 3 of 13 sectors positively contributed to the statistic. This is due to increasing price pressures from energy and material costs.

Eurozone’s industrial production remained stronger than expected throughout June. Industrial production expanded by 0.7% month-over-month. May’s reading was revised higher to 2.1% month-over-month. The positive drivers of growth was a 2.1% increase in the production of capital goods and a 0.6% month-over-month increase in the production of energy. This was offset by a 2.3% decrease in non-durable goods, 1.1% decrease in durable goods and 0.3% month-over-month decrease in intermediate goods.

Quick look ahead

Canada – Manufacturing and wholesale sales (August 15); Housing starts (August 16); CPI (August 16); Retail sales (August 19)

StatCan will release June’s manufacturing and wholesale sales data on August 15. In May, manufacturing sales saw a 2.0% decrease but wholesale sales experienced an expansion of 1.6% month-over-month.

The Canadian Mortgage and Housing Corporation will release July’s housing starts data. Housing starts have surprisingly seen consistent outperformance for the last three months. Housing starts are forecasted to have a reading of 265K, down from 273K in June.

StatCan will publish Canada’s CPI data for July on August 16. Consensus estimates are expecting CPI to have a reading of 8.4%, up from June’s reading of 8.1% year-over-year.

StatCan will release retail sales data for June on August 19. Retail sales has consistently done well throughout 2022 because of higher prices, despite declining sales volumes. Sales expanded 2.2% month-over-month during May.

U.S. – Empire manufacturing survey (August 15); Housing starts (August 16); Industrial production (August 16); Retail sales (August 17)

On August 15, The Federal Reserve Bank of New York will release their Empire manufacturing survey findings for August. The index is expected to decline to 5.0 from 11.1.

The Census Bureau will release U.S. housing starts data for July on August 16. Housing starts have been underperforming for the past three months due to developer concerns over quantitative tightening. Consensus estimates are expecting housing starts to come in at 1.54M.

The Federal Reserve will have its industrial production release for July on August 17. Production is forecasted to increase by 0.3%, up from a contraction of 0.2% month-over-month in June. Losses were broad-based in June, with only three market groups (home electronics, miscellaneous and clothing) posting gains.

The Census department will publish U.S. retail sales data for July. Consensus estimates are forecasting sales to grow by 0.2%, down from growth of 1.0% month-over-month in June.

International – Japan’s GDP (August 14); China’s industrial production (August 14); U.K. CPI (August 17); Japan’s CPI (August 18); U.K. retail sales (August 19); German PPI (August 19)

The Cabinet Office will release Japan’s advance GDP estimates for the second quarter. Japan is expected to escape a technical recession with a forecasted expansion of 0.6% quarter-over-quarter.

The National Bureau of Statistics will release China’s industrial production data for July. Building on momentum from June’s reopening, production is expected to expand by 4.6% year-over-year.

The Office for National Statistics will release the U.K.’s CPI data for July. Consensus estimates are expecting CPI to have a reading of 9.8% year-over-year and 0.4% month-over-month.

Japan’s Statistics Bureau will publicize their CPI data for July. CPI is expected to slightly increase to 2.4%, up from 2.2% year-over-year in June.

The Office for National Statistics will have the U.K’s retail sales release for July. Retail sales have experienced contractions for the past two months due to sharp decreases in demand from rising inflation. This trend is expected to continue with forecasted contractions of 3.3% year-over-year and 0.2% month-over-month.

Destatis will release Germany’s PPI data for July. PPI is expected to increase to 0.5% month-over-month. German producers have experienced high inflation throughout 2022 and this is expected to continue after a suboptimal PMI report for July.