Weekly Market Pulse - Week ending June 14, 2024

Market developments

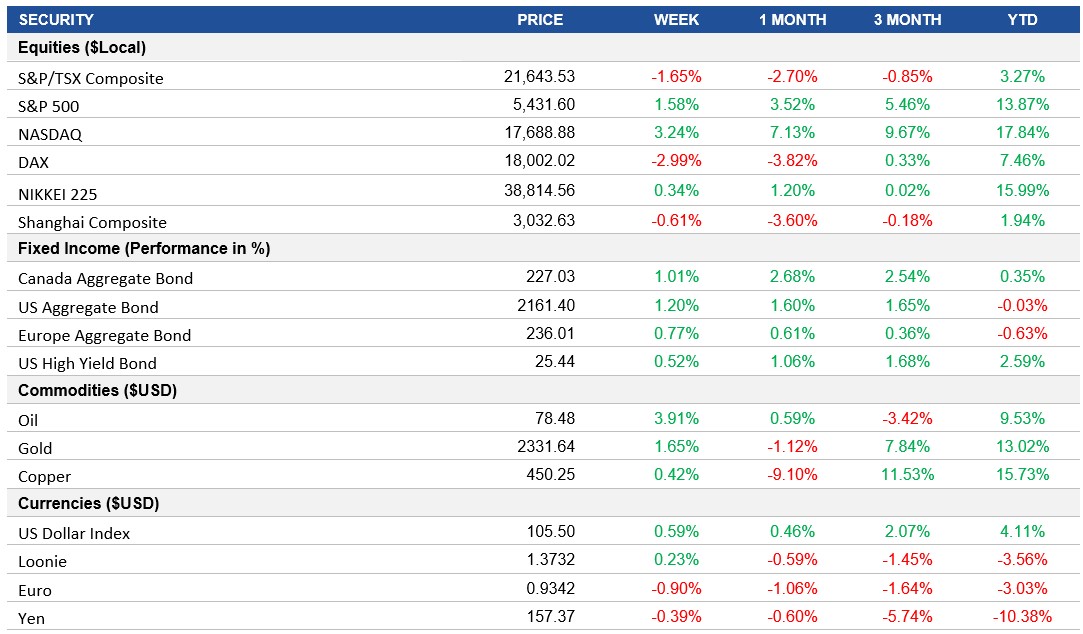

Equities: France's CAC 40 index was down around 2.6% on Friday, on pace for its largest weekly drop since March 2022, weighing on the broader Stoxx 50 index. The sell-off in French stocks is driven by concerns over the upcoming snap election, where polls indicate strong support for a populist far-right party advocating anti-EU policies and increased spending. The S&P 500 and Nasdaq continued their strength on the back of better than expected inflation reports and were up ~1.6% and ~3.2% for the week.

Fixed Income: U.S. Treasury yields moved to fresh weekly lows, with the 10-year yield around 4.2%, as better than expected CPI and PPI reports improved sentiment around rate cuts in the U.S., French and Italian bond spreads widened aggressively versus German Bunds due to political uncertainty in Europe.

Commodities: Oil prices have risen nearly 8% since touching a four-month low of $73.25 on June 4. The rebound was driven by expectations of higher summer demand amid the U.S. driving season and OPEC+'s decision to extend 2.2 million barrels per day of voluntary supply cuts through September.

Performance (price return)

Source: Bloomberg, as of June 14, 2024

Macro developments

Canada – No Notable Releases

No notable releases this week.

U.S. – U.S. Inflation Slows in May 2024, U.S. Producer Prices Decline, Federal Reserve Maintains Interest Rates

The annual inflation rate in the U.S. slowed to 3.3% in May 2024, the lowest in three months. Decreases were noted in food, shelter, transportation, and apparel prices, while energy costs rose. The Consumer Price Index (CPI) was unchanged from the previous month, countering expectations of a 0.1% increase. Core inflation also slowed to 3.4% annually, the lowest since April 2021.

Produce prices in the U.S. fell by 0.2% in May 2024, contrary to expectations of a 0.1% increase. The significant drop was mainly due to a 7.1% decline in gasoline prices. Other goods such as diesel fuel, chicken eggs, and jet fuel also saw price decreases, while prices for final demand services remained unchanged.

The Federal Reserve kept the federal funds target range at 5.25%-5.50% in June 2024. Policymakers plan only one rate cut this year and four in 2025, revising down from earlier projections. GDP growth projections remain unchanged, while inflation forecasts for 2024 and 2025 have been revised higher. The unemployment rate forecast remains at 4% for 2024 but is slightly higher for 2025 at 4.2%.

International – U.K. Unemployment Rises, Japan’s Producer Prices Surge, China’s CPI Shows Steady Growth

The U.K.'s unemployment rate increased to 4.4% from February to April 2024, the highest since September 2021. The number of unemployed individuals rose by 24,000 to 1.51 million, with increases seen across all durations of unemployment. The number of employed individuals also grew, driven by part-time and full-time self-employed workers, while full-time employment decreased. Economic inactivity rose to 22.3%.

Japan's producer prices increased by 2.4% year-on-year in May 2024, the highest since August of the previous year. This marks the 40th consecutive month of growth, with significant rises in costs for nonferrous metals, scrap & waste, and petroleum & coal products. However, prices fell for electric power, gas, water, lumber, and minerals. Monthly producer prices rose by 0.7% in May.

China's consumer prices rose by 0.3% year-on-year in May, marking the fourth consecutive month of gains, indicating a steady recovery in domestic demand. Core CPI, excluding food and energy, increased by 0.6%. On a monthly basis, the CPI slightly decreased by 0.1%, less than the average decline of 0.2% for the same period over the past decade.

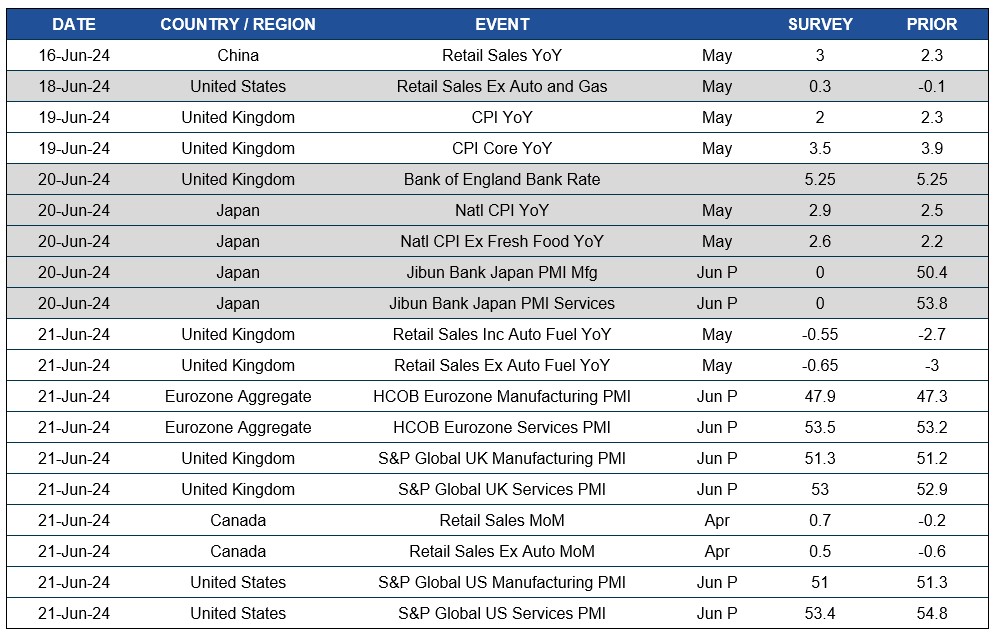

Quick look ahead

As of June 14, 2024